Referral Sources

Expertise. Flexibility. Execution.

Referral Sources

The Expertise You’re Looking For.

SLR Healthcare ABL offers the specific, healthcare-related financing expertise you need.

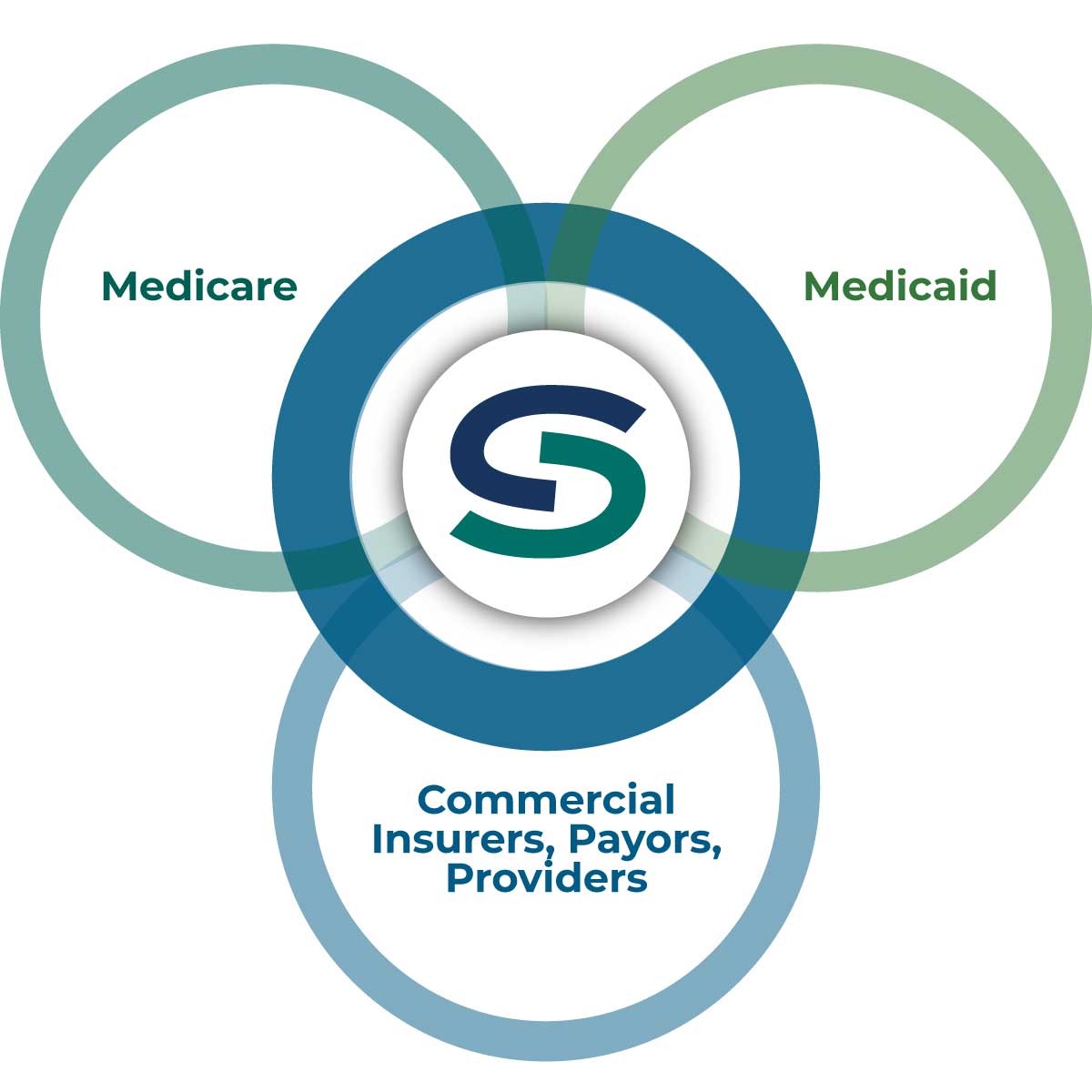

When traditional financing options are not available, we can provide alternative funding that leverages your client’s assets. Our ability to finance against third party receivables including Medicare, Medicaid, commercial insurers, and corporate payors gives you financing options not available with other commercial finance firms or banks.

Referral Sources

The Flexibility Your Clients Truly Need.

We get it. Your client’s deal isn’t plain vanilla, and we only offer custom solutions. Our case studies show how hard our underwriters work to structure deals to client specifications.

While our lending relationships always consist of an asset-based revolving line of credit, each is customized to your client’s unique circumstances. In some cases, our lines of credit are supplemented by a senior term loan or real estate loan, depending on what specific solution your client needs.

Download our fact sheet.

All you need to know.

Referral Sources

The Execution That Creates a Win-Win-Win.

We’re different. SLR Healthcare ABL executes our deals with superior attention to both detail and timing. When it’s critical to get the structure right and the deal done on time, we care enough to make it happen.

Latest Deals

Chronic Care Physician Services and Technology Company

$7,500,000

Asset-Based Revolving

Line of Credit

June 2024

Specialty Physician Practice Management Group

$5,000,000

Asset-Based Revolving

Line of Credit

July 2024

Medical Device Company

$15,000,000

Asset-Based Revolving

Line of Credit

January 2024

Third-party Receivables

We stand apart in our ability and willingness to finance third party receivables, including A/R due from Medicare, Medicaid, commercial insurers, corporate payors, and other healthcare providers.

client profile

Typical partner clients have annual revenue of $20MM+ and a financing need of $2-$40MM.

Case Study

Our lending relationships always consist of a revolving line of credit, supplemented in certain cases by a senior term loan or real estate loan, each tailored to our partner client’s unique circumstances.