Substance Use Disorder Treatment Providers Financing

Our consistency resolves uncertainties.

Financing for Substance Use Disorder (SUD) treatment providers is challenging. Market forces are changing the business model of these critical facilities, with the emergence of value-based care, at-risk models, and bundled payments creating reimbursement uncertainty. Serving Medicaid patients often results in coverage limitations and thin margins. Treating out-of-network patients results in longer waits and more red tape to get claims paid.

Substance Use Disorder Treatment Providers Financing

Understanding the Challenges.

We’re Different. We understand that SUD treatment providers are in a moment of transition. Moving away from fee-for-service and toward value-based care means providers are assuming more reimbursement risk. Delays in out-of-network reimbursement puts operational expenses under increasing pressure. Customer acquisition cost (CAC) is high in this competitive market, further tightening margins. While SUD payment models are changing, the sector remains a critical, life-saving piece of the healthcare provider landscape.

We understand

Value-Based Care

Pressure from payors toward at-risk and bundled payment arrangements to reduce fragmentation and increase the quality of care

Reliance on Medicaid

With over 83 million Americans enrolled in Medicaid, it has become the single largest source of funding for SUD services

Out-of-Network Payment Delays

SUD providers are often out-of-network with commercial payors, resulting in higher reimbursement but much longer AR turnover than in-network payor contracts

High Competition

Competition for patients is driving increasingly high digital and traditional media marketing costs

Access to Caregivers

A shortage of therapists and counselors exacerbates gaps in care and drives up operating costs

$12 billion annual Medicaid payments for SUD services

Substance Use Disorder Treatment Providers Financing

Knowing the Details.

We get it. We know how to finance third-party insurance reimbursements in the SUD space, easing cash flow and accessing funding streams that were previously unavailable. We are experienced at analyzing companies just like yours and structuring asset-based loans that address the unique nuances of the SUD space.

We know

How to create cash flow from unpaid third-party accounts receivable

That SUD treatment providers are experiencing a significant payment model transition, which can influence liquidity, margins, and overall operations

How payment delays, provider credentialing, and at-risk reimbursement models impact your accounts receivable

How reliance on Medicaid increases census but often reduces margins

How the tight labor market increases operating costs and reduces access to therapists and caregivers

Crafting the Solution.

SLR Healthcare ABL offers SUD treatment provider financing to address the rapidly changing payment models within behavioral and mental health fields. Our asset-based revolving lines of credit allow SUD treatment providers to focus more on the delivery of excellent care, and worry less about managing their cash flow.

$9mm

in substance use disorder treatment providers financing

Provider of Substance Use Disorder Treatment

$5,000,000

Asset-Based Revolving

Line of Credit

December 2020

Provider of Mental Health and Substance Use Disorder Treatment

$4,000,000

Asset-Based Revolving

Line of Credit

December 2020

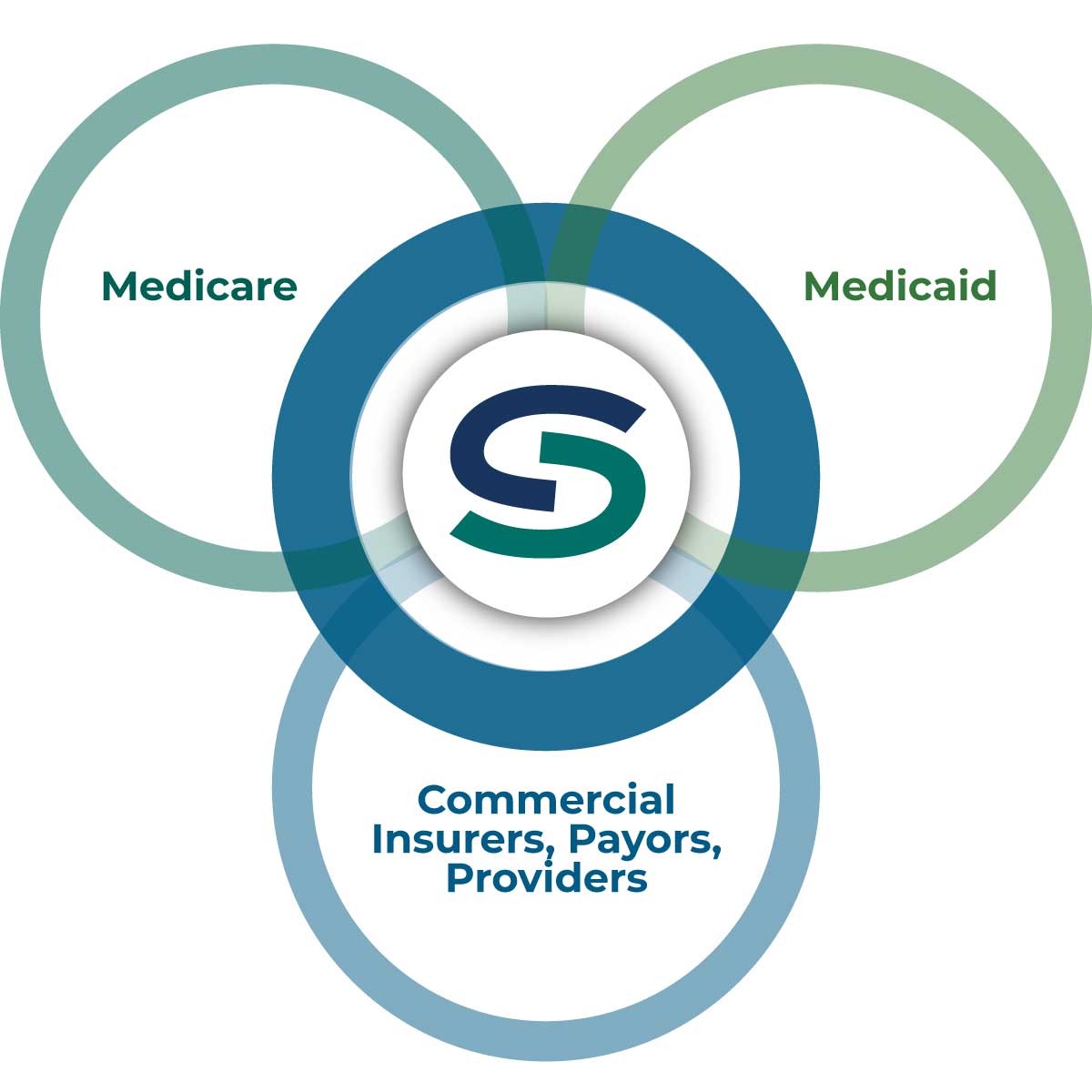

Third-party Receivables

We stand apart in our ability and willingness to finance third party receivables, including A/R due from Medicare, Medicaid, commercial insurers, corporate payors, and other healthcare providers.

client profile

Typical partner clients have annual revenue of $20MM+ and a financing need of $2-$40MM.

Case Study

Our lending relationships always consist of a revolving line of credit, supplemented in certain cases by a senior term loan or real estate loan, each tailored to our partner client’s unique circumstances.