Hospital Financing

Our execution meets your needs.

Hospital financing is critical to maintain viable health care systems. Labor costs, staffing challenges, and shifting government support can dramatically impact a hospital’s ability to finance operations.

Hospital Financing

Understanding the Challenges.

We’re Different. We understand the complex financing needs of hospital systems. Labor costs, staffing shortages, and lower occupancy are all affecting the bottom line. Expense inflation, shifts in uncompensated care, and uneven physician enterprise alignment can further impact margins. Add to these factors the need to balance inpatient/outpatient beds, maintain nursing ratios, and address aging infrastructure – and the need for astute financial solutions becomes clear.

We understand the significant implications of:

Labor Costs and Staffing Shortages

77% of hospitals cite labor shortage and staffing agency reliance as major financial challenges

Expense Inflation

Growing at 2x the rate of Medicare reimbursement in some areas

Physician Enterprise Losses

Associated with misalignment of physician enterprise groups

Patient Volumes

Decreasing as hospital length of stay increases

%

77% of hospitals cite labor shortage

Hospital Financing

Knowing the Details.

We get it. We know that the reduction of pandemic-related stimulus and state-specific uncompensated care subsidies can significantly affect revenue and liquidity. Shifts in the mix of inpatient and outpatient volume can negatively impact margins. Any one of these factors can cause operational shortfalls, negative profit margins, and lower funding for capital improvements.

We know the impact of market forces on cash flow

The mix of inpatient and outpatient census and reimbursement rates on operating costs

The disconnect between expiring Covid retention credits and ongoing labor expenses

The dependence of each hospital system on subsidies for uncompensated care

Crafting the Solution.

SLR Healthcare ABL offers hospital financing to address complicated challenges. Our asset-based revolving lines of credit allow hospitals to manage staffing costs, offset the impacts of reimbursement rates and government support, and align physician and patient needs to enhance ongoing growth.

$10mm

in hospital financing

Hospital

$5,000,000

Asset-Based Revolving

Line of Credit

July 2024

Hospital

$3,000,000

Asset-Based Revolving

Line of Credit

December 2023

Hospital

$2,000,000

Asset-Based Revolving

Line of Credit

November 2021

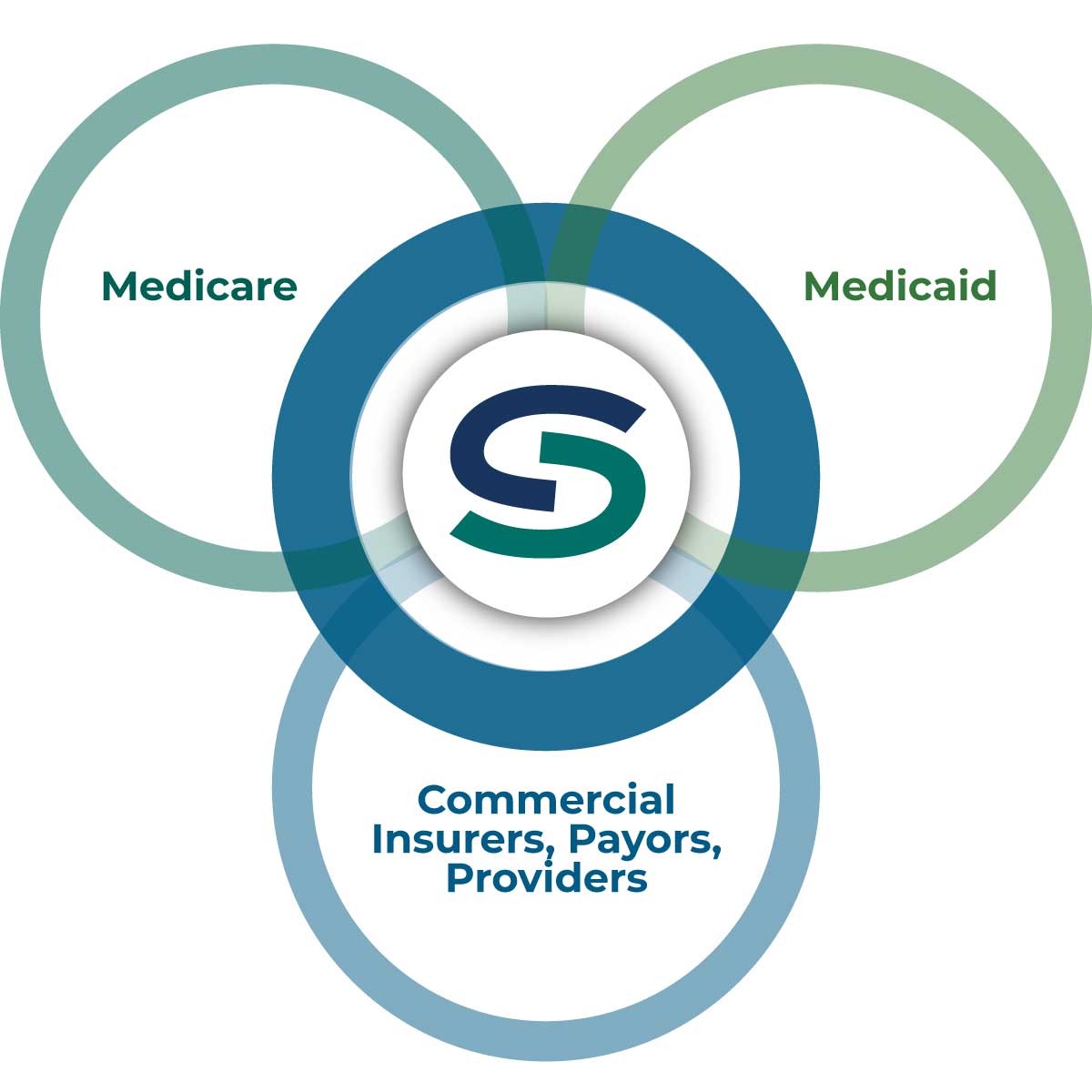

Third-party Receivables

We stand apart in our ability and willingness to finance third party receivables, including A/R due from Medicare, Medicaid, commercial insurers, corporate payors, and other healthcare providers.

client profile

Typical partner clients have annual revenue of $20MM+ and a financing need of $2-$250MM.

Case Study

Our lending relationships always consist of a revolving line of credit, supplemented in certain cases by a senior term loan or real estate loan, each tailored to our partner client’s unique circumstances.