Home Healthcare Agency Financing

Our Expertise Alleviates Your Concerns.

Home health agency providers delivering both Medicare and Medicaid services face financing challenges caused by rising healthcare labor costs, the scarcity of qualified workers, the transition to managed care plans, and a heightened regulatory environment.

Home Healthcare Agency Financing

Understanding the Challenges.

We’re Different. We understand that home healthcare agency providers need specialized financing. With vast differences between skilled and unskilled patients, services, and reimbursement, generalist lenders struggle to understand the industry fundamentals.

We understand

The Expansion of Managed Care Plans

The penetration of managed Medicare and Medicaid plans means providers must negotiate rates with multiple payors, with payment delays being commonplace

Major Changes in Medicare Reimbursement

Under the PDGM, the change in payment timing from 60-day periods to 30-day periods creates real cash flow challenges for providers

Therapy Thresholds

Elimination of therapy visits as a payment factor will eventually have an adverse impact on revenue for high-therapy agencies

Medicaid Underfunding

While demand for community-based services and costs are both rising, Medicaid reimbursement often falls short of the actual cost of care

Caregiver Shortages

Demand for nurses, LPNs, and home health aides is increasing, but competition is also increasing, causing wage inflation and higher agency utilization

%

80% of skilled home health care bills are reimbursed by the government, with CMS signaling reimbursements may be tightening

%

Payroll is 70-80% of the cost structure for home health agencies, meaning liquidity is critical.

Home Healthcare Agency Financing

Knowing the Details.

We get it. We know how to finance third-party insurance reimbursements, easing cash flow and accessing funding streams that were previously unavailable. We are experienced at analyzing companies just like yours and structuring asset-based loans that address the unique nuances of the home health space.

We know

How to create cash flow from unpaid third-party accounts receivable

How payroll is 70% – 80% of your cost structure and access to liquidity is critical

How payment delays, provider offsets and recoupments impact your accounts receivable

How low reimbursement rates and rising costs affect your operating margins

Crafting the Solution.

SLR Healthcare ABL offers home health care agency provider financing that targets specific reimbursement challenges. Our asset-based revolving lines of credit allow home health care agencies of all types to manage costs, offset the impacts of reimbursement rates, and modulate cash flow in uncertain times.

$10mm

in home healthcare agency financing

Home Healthcare Agency

Home Health & Hospice Provider

Home Healthcare Agency

$2,000,000

Asset-Based Revolving

Line of Credit

November 2021

Third-party Receivables

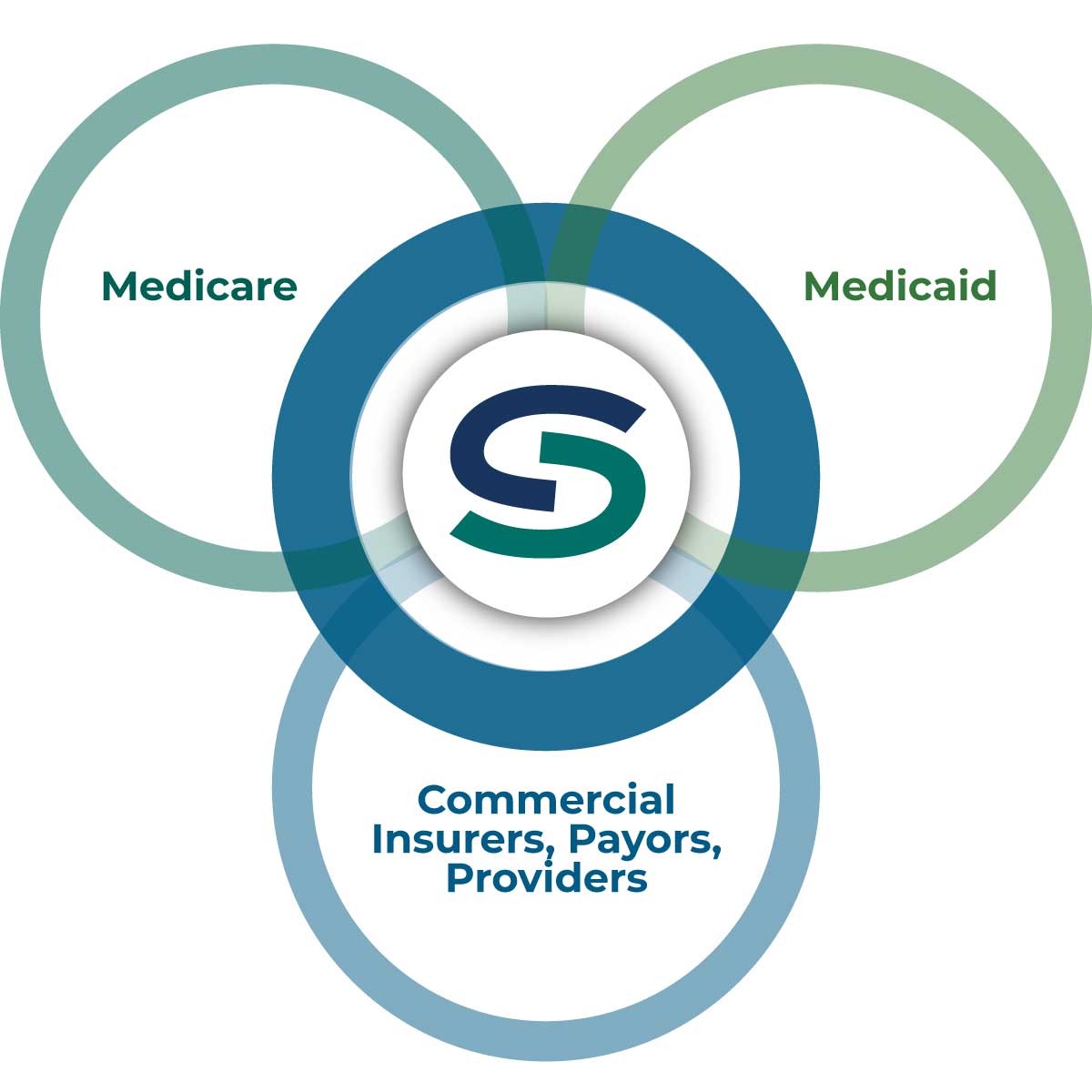

We stand apart in our ability and willingness to finance third party receivables, including A/R due from Medicare, Medicaid, commercial insurers, corporate payors, and other healthcare providers.

client profile

Typical partner clients have annual revenue of $20MM+ and a financing need of $2-$40MM.

Case Study

Our lending relationships always consist of a revolving line of credit, supplemented in certain cases by a senior term loan or real estate loan, each tailored to our partner client’s unique circumstances.