Medical Staffing Agency Providers Financing

Our flexibility matches your goals.

Medical staffing agency providers need financing to fill a critical need in the health care delivery system. Post-Covid demand for agency staffing has declined due to lower patient census at many hospitals and long-term care facilities. This has decreased agency demand in the short run. However, the medical staffing sector is expected to continue to grow due to the growth in chronic disease states and the aging of the population.

Medical Staffing Agency Providers Financing

Understanding the Challenges.

We’re different. We understand that medical staffing agency providers face complex financing challenges. Demand for agency usage is softening post Covid, with reduced utilization and conversation rates for requested shifts. With competition from the “gig economy,” technology-driven newcomers in the market are forcing traditional players to adapt. A growing focus on maintaining key client relationships and protecting market share has become critical.

We understand

Lower Facility Census

Many healthcare facilities are experiencing declining facility census, reducing staffing demands

Utilization and Inquiry Conversion Rates

Lower demand is leading to increased cancellation trends and shift conversion rates as low as 25%

Emergence of On-Demand Staffing Models and Digital Staffing Apps

There is increased competition from new players offering technology-based platforms

Access to Staffing

The “great retirement” and low graduation rates has added to the nursing shortage

Growth Expectations

The healthcare staffing market will increase to $101B by 2036, with a notable increase in the nursing home space

The healthcare staffing market will increase to $101B by 2036

Medical Staffing Agency Providers Financing

Knowing the Details.

We get it. We know how to finance healthcare provider receivables, easing cash flow and accessing funding streams that were previously unavailable. We are experienced at analyzing companies just like yours and structuring asset-based loans that address the unique nuances of the healthcare staffing sector.

We know

That the demand for healthcare staffing has softened due to lower facility occupancy.

That competition for nurses and certain other care givers remains high.

That the emergence of app-based providers is increasing competition.

That provider recruiting, training and credentialing causes reimbursement delays.

Crafting the Solution.

SLR Healthcare ABL offers medical staffing agency provider financing to address the complex supply and demand challenges of the healthcare workforce. Our asset-based revolving lines of credit allow medical staffing agencies to maintain cash flow, smooth out payment gaps, and support ongoing growth in the healthcare staffing space.

$10mm

in medical staffing agency providers financing

Therapy Staffing Company

$4,000,000

Asset-Based Revolving

Line of Credit

August 2023

Medical Staffing Company

$4,000,000

Asset-Based Revolving

Line of Credit

April 2021

Home Healthcare Agency

$2,000,000

Asset-Based Revolving

Line of Credit

November 2021

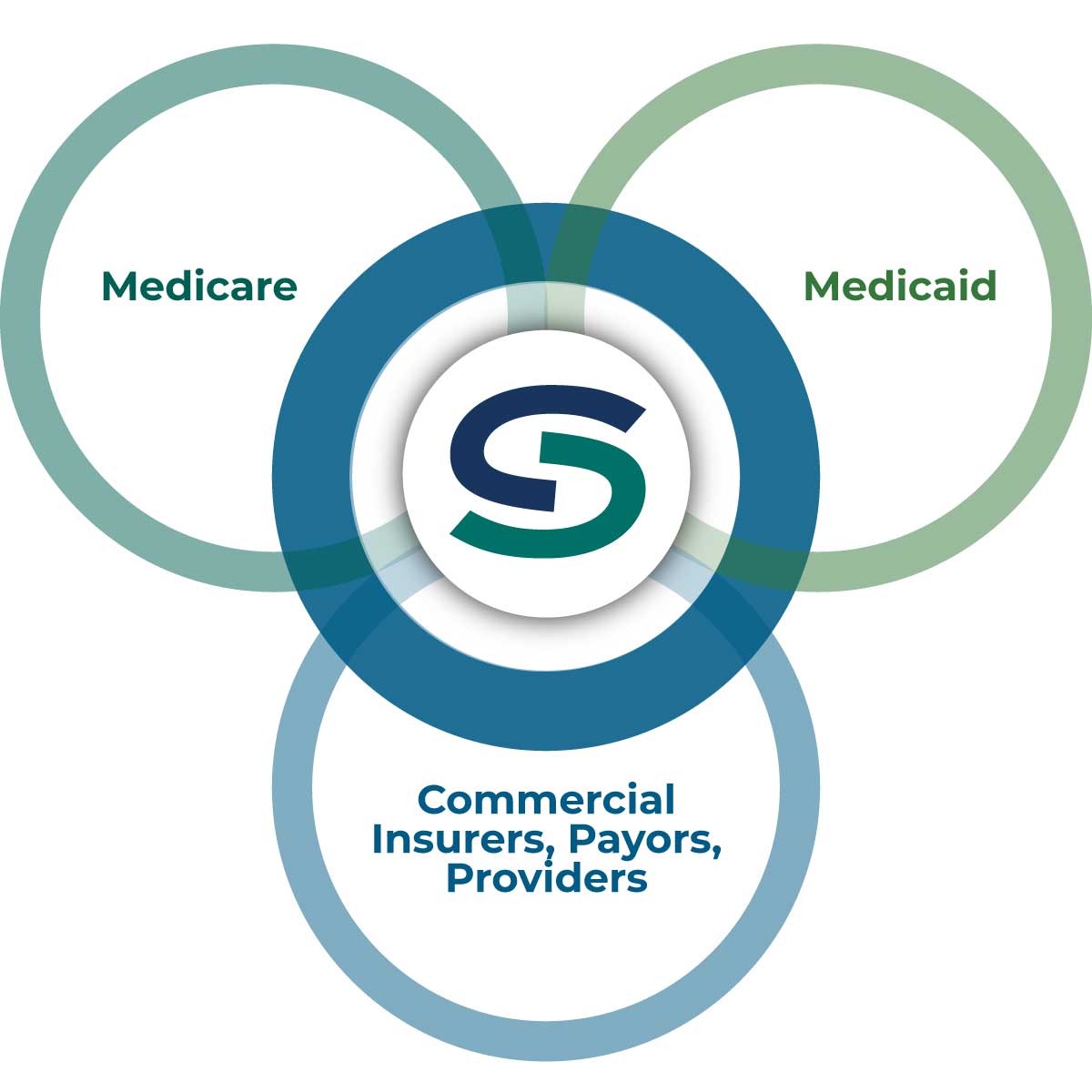

Third-party Receivables

We stand apart in our ability and willingness to finance third party receivables, including A/R due from Medicare, Medicaid, commercial insurers, corporate payors, and other healthcare providers.

client profile

Typical partner clients have annual revenue of $20MM+ and a financing need of $2-$40MM.

Case Study

Our lending relationships always consist of a revolving line of credit, supplemented in certain cases by a senior term loan or real estate loan, each tailored to our partner client’s unique circumstances.